Credit Spread Option Trading-2/17/22

- daytradingtraveler

- Feb 17, 2022

- 2 min read

Credit spreads are a great way to capitalize on a perceived trending range a stock will have in the short term. Whether you are bullish or bearish, you can create a credit spread that reduces risk, provides its own natural hedge, and decrease the amount of margin needed on your account to leg into your technical trend perception.

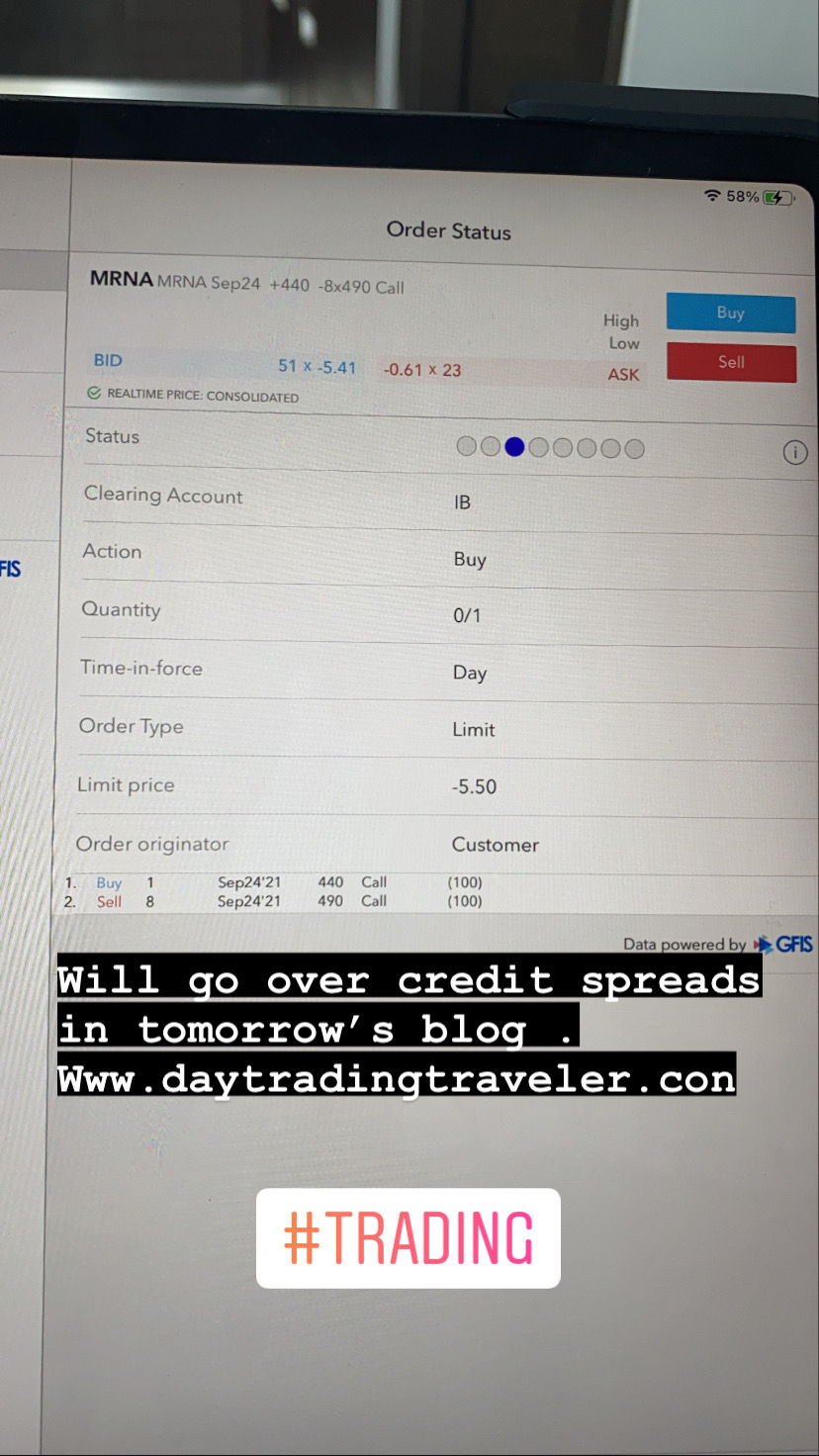

Let's look at an example on MRNA, that I am currently looking to execute today/this coming week to capitalize on my anticipated market outcome for the stock. These credit spread will use calls as I am anticipating a bullish trend on MRNA, but with some market resistance at my anticipated target. MRNA is currently trading at 439, which I believe to be a bit low in this current covid environment. As such, I want to buy a call with an ATM strike, which would be 440 for this example. The current premium on the 440 call is ~15.00. If I purchase this call, it will cost me $1,500 . However, I want to cover my cost , provides myself a hedge for a downswing, and to gain value on my 490 resistance level for the stock. In order to do this, I am going to sell strikes at 490, which are currently trading at a premium of 2.25. So , essentially , I would need to sell 6.6 calls to cover the premium of the call I bought. So, essentially, I would sell 7 calls, to cover my premium and this trade would give me a window trading range between 455-490 where I would gain on both trades, which is a large gap to be profitable. Lets look at the math below:

Buy Call: 440strike + 15.00 premium = BE(break even) @455. Any price greater than 445 is profitable

Sell Call: 490 Strike +2.25 premium= BE @ 492.25. Any price less than 490 gain full value of premium : Profit ~1,500

Max Profit= Full Value of Sold Call (1,500 @490) + Buy Call ( = (490strike-455)strike*100)

Max Profit = 1500 (sold call)+ 3500(long call) = $5000

Scenario A: Stock Stays Below 455/Drops

Lose full value of the 440 long call of $1,500 but gain full premium on 490 short call = net $0

Scenario B: Stock Goes above 490 strike

Incurr losses on a higher multiple of the 7 @490 strike calls sold (need to unwind/hedge on market momenetum change.

This trade has a great upside, with a hedge to the downside , and risk to the upside swing if the stock gets over the 490 strike short call.

Below is an example of the trade. You would need to execute this trade as a option strategy and your purchase price would need to be ~$5,000 that is calculated above.

Comments